What will happen to property in 2021 //

You’ve likely heard it a lot recently but the world of property is changing significantly at the moment. This is the case for both the residential and commercial markets so we’re going to highlight a few changes, and throw our hat into the ring when it comes to opinions.

What will happen to the UK housing market //

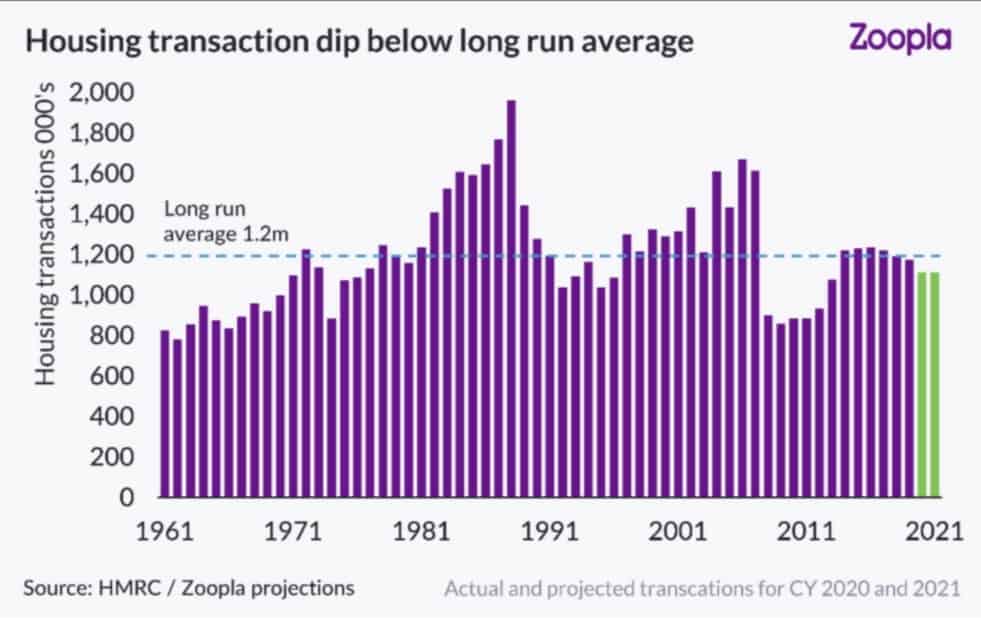

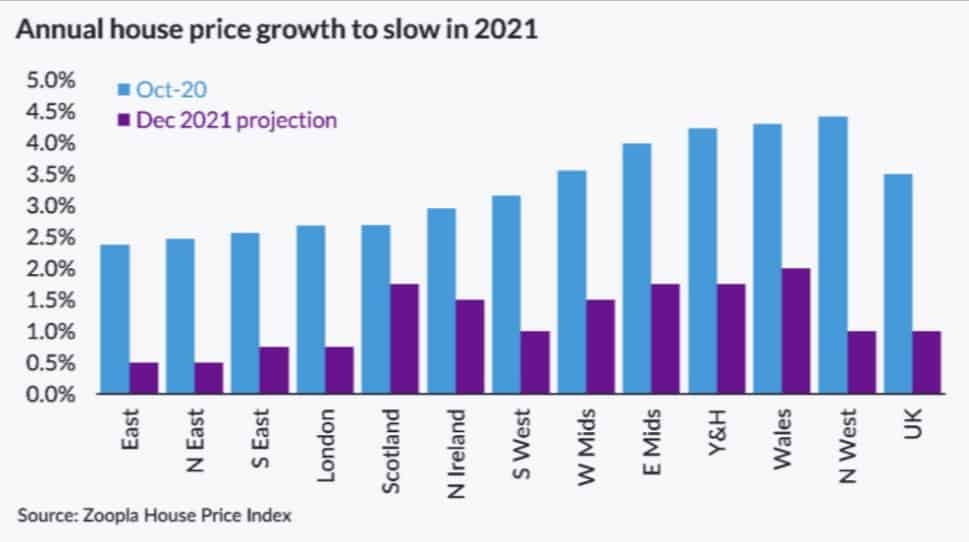

House prices ended 2020 at a record high, but this is predicted to slow with prices expected to drop when the stamp duty holiday ends at the end of March.

The residential market is still busy as buyers continue to look for new homes, however, Zoopla is predicting that half of January’s sales won’t complete in time for stamp duty relief, and some commentators have raised concerns that this could result in buyers pulling out of sales as the tax returning adds 2-15% on to the property price*.

The Royal Institution of Chartered Surveyors (RICS) found most members expect weaker sales in the year ahead, with some citing rising unemployment and the looming return of higher stamp duty and land tax levels across the UK. However, Zoopla also suggested a shortage of stock after 2020’s sales boom could limit price declines, saying:

“the scale of any downside for prices and turnover in 2021 is lower than in previous downturns”

The boom in 2020 looks to have been heavily driven by second and multiple home owners and the higher end of the market, where property remains seen as a good long-term investment project and whose jobs have been less hit by lockdown restrictions and redundancies. This suggests that the market may not have as a heavy a fall as some predict, although will still likely be impacted by the return of stamp duty.

Another area that may help the housing market to continue on a positive trajectory is changes in working habits causing an increased demand, something Zoopla believes still “has further to run” as changes to working patterns continue through 2021 and beyond. There has been a big increase in searches for property with greater access to outdoor space as people move away from city centre working, with many people requiring greater flexibility with the space they have as they continue with home based working. The impact of the pandemic on working practices is very likely to be felt for years to come, and thus we will continue to require more from our homes as they increasingly become a hybrid of work and leisure time.

When we talk of the future, it would be difficult to shy away from the climate emergency and the environmental choices we need to make. We have written more extensively on environmental building practices here, but this is likely to be an area to watch as we look to reduce our impact on the environment through more energy efficient homes and construction.

*This is dependent on value of property and whether it is one residential property or a second, or multiple, home.

What will happen to UK commercial property //

The future of commercial property is incredibly interesting, to us at least. There is undoubtedly going to be change in the way businesses operate moving forward as they look to adapt post pandemic, although some of this change was arguably already in the making and just exacerbated by the pandemic.

Retail, for example, has been heavily impacted for years by the growth of online sales, but with us all forced to stay home multiple times over the past year, the world of online shopping became even more lucrative. What will happen to these buildings? Where anchor tenants like Topshop and Debenhams once stood, who will take over? We think it’s important here to consider what is lacking in a certain town or city and how these spaces can be repurposed. Sheffield, for example, has long had a lack of both housing and Grade A office space, whilst other areas may well see growth of bars and restaurants as people long to get back to socialising.

Offices will of course change, we’re all working from home where we can and for many people this has been beneficial in giving them more time as they avoid a potentially lengthy commute. Moving forward, there will very likely still be a use for offices as we look at a more hybrid working pattern with a mix of home and office use. Although demand for office space may drop, prior to the recession demand outweighed supply so this could bring about a more level field. Changes in working patterns are also forcing current owners, landlords and businesses to look at the quality of the office they’re providing. Several buildings in Manchester, for example, are being retrofitted with showers, bike storage and recreational areas, offers now seen as essential by many employees. Offices in towns and cities will likely be in demand again as we leave the pandemic behind, even though home working will continue to be popular, a flexible solution of home and office working will likely be the new normal.

We also think they’ll be a greater move towards experiences, with businesses offering consumers more than just one activity such as shopping. Manchester’s Arndale Centre, for example, had already started to repurpose units, creating a prosecco bar to drink while you shop, whilst Junkyard Golf in Manchester saw huge success with an activity and a night out rolled into one. Some spaces, particularly shopping centres, will likely be entering an extensive period of redevelopment as they look to bring consumers back into their units, finding news way to entice them.

So what will be the focus of property post-coronavirus //

We believe the future of property lies in residential, offices and experience driven services, so we’ll see town centres with greater hospitality, more city centre living and thus urban green spaces, and offices that offer something new to their staff. There’ll be a lot of repurposing of existing spaces, and we think quite a few commercial to residential developments as centres change and become more attractive places to live again.

When looking at what has happened after other recessions, it’s difficult to compare. The 2008 crash was a different experience to nwo because it was created from banks having no money, and the exacerbation of the housing crisis caused everything to stop. This situation is different. The recession we do see may well be reflected in isolated industries as opposed to the whole economy going down. Banks do have money and there will likely be a short sharp recession and a huge bounce back. Demand for businesses that closed, such as pubs, restaurants and hairdressers, will return because the loss of demand was due to the manufactured situation of lockdown, and the consumer demand is actually still there.

The pandemic will be a catalyst for change for how businesses do things, with many likely coming back with a different model. There are also opportunities for other sectors to grow. The property industry for example, will be implementing change, doing due diligence, advising on changes of use, and creating and building new spaces.

Change is scary for some, but as the vast industrial heartlands of the north have been forced to find rejuvenation and a new purpose, so will many of our current retail spaces. Change isn’t always a bad thing. If it weren’t for deindustrialisation, I’d probably be covered head to toe in soot down a mine or at the Furniss, instead of writing this blog comfortably at home in my shirt with a coffee. ‘Proper work’ my old Grandad would say, maybe he was right, a real tragedy I’ll never know, I’m sure. In short, looking to the future there is definitely a period of change, but repurposing what is there and creating new things can be a positive as we move forward and say goodbye to covid.

This information and data in this article was correct at the time of publishing. However, it may now be out of date or superseded. Fourth Wall make no representation or warranty of any kind regarding the content of this article and accept no responsibility or liability for any decisions made by the reader based on the information/ data shown here.

Comments are closed.